A Fiduciary Commitment to Comprehensive Advice

We’ve developed a distinct financial planning method, Wealth Avenue, designed to help navigate the financial steps you take through life’s journey. As life evolves, so should the roadmap to your financial strategy. We’re perpetually refining our approach and advice to uphold our commitment to you: guiding you to enhance your financial well-being, so you can live in the moment and in the future.

In this fiduciary capacity, we offer comprehensive counsel. This may include partnering with specialists in tax planning, estate planning, real estate, and philanthropy.

We understand that no two clients are alike, which is why we take the time to map out a strategy that reflects your individual circumstances, values, and objectives.

To best serve your unique needs, we’ll map out a financial plan centered around your specific goals.

- Our process

Our planning process typically includes, but is not limited to, the following key elements:

Identifying Life Goals and Values

We begin by helping you clarify your life goals and the values that drive your financial decisions. Whether your priorities include achieving financial independence, supporting your family, or leaving a legacy, understanding your core values allows us to tailor a plan that aligns with what matters most to you.

Analyzing and Monitoring Net Worth and Cash Flow

A thorough analysis of your current financial situation is essential. We assess your net worth, income, expenses, and cash flow to create a clear picture of your financial health. Regular monitoring helps to ensure that your finances stay on track, allowing for adjustments as needed to accommodate changes in your life or financial environment.

Evaluating Insurance Needs

Life is unpredictable, and having the right insurance coverage is critical to protecting your financial future. We evaluate your needs for life, disability, and long-term care insurance, ensuring that you and your loved ones are safeguarded against unexpected events.

Planning for College Savings

If education is a priority for your family, we help you plan for college savings, exploring options like 529 plans and other tax-advantaged accounts. Our goal is to create a strategy that allows you to fund education costs without compromising your other financial objectives.

Crafting Tax Reduction Tactics

Minimizing your tax burden is a key component of our financial planning process. We develop tax reduction strategies that may include optimizing deductions, utilizing tax-advantaged accounts, and planning for the timing of income and expenses. Our proactive approach aims to ensure that you keep more of your hard-earned money while staying compliant with tax laws.

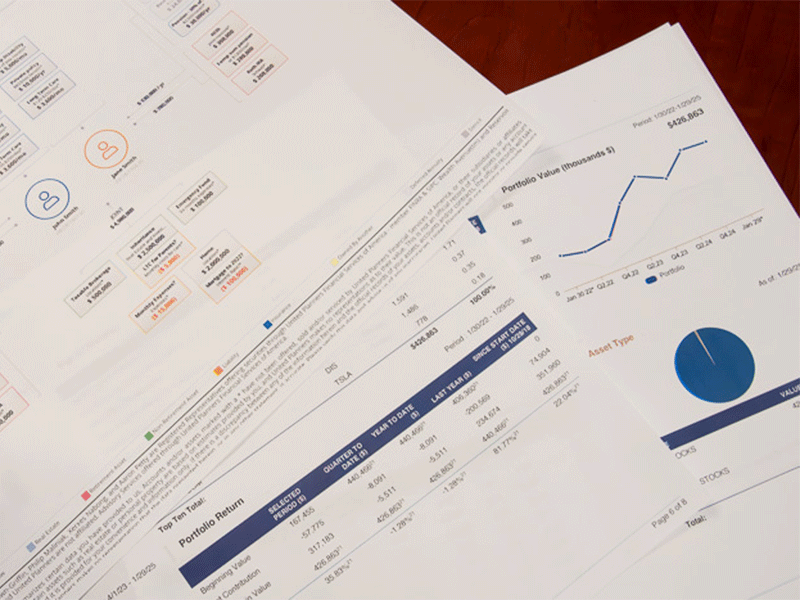

Designing Investment Portfolios

A well-structured investment portfolio is essential for building and preserving wealth. We design portfolios tailored to your risk tolerance, time horizon, and financial goals. Whether you’re focused on growth, income, or a balanced approach, our investment strategies are customized to help you achieve your objectives.

Real Estate Investment Analysis

Real estate can be a powerful asset in your financial portfolio. We provide analysis and advice on real estate investments, whether you’re considering purchasing property, managing rental income, or evaluating the long-term value of your real estate holdings.

Preparing for Retirement

Retirement planning is about more than just saving—it’s about creating a plan to help ensure you can enjoy your retirement years without financial stress. We help you prepare for retirement by analyzing your savings, projecting your retirement needs, and developing a strategy that allows you to retire with confidence.

Outlining Retirement Income Payments

Once you retire, managing your income is crucial to maintaining your lifestyle. We outline a retirement income plan that includes Social Security benefits, pension payouts, and withdrawals from retirement accounts. Our goal is to ensure you have a steady, reliable income stream throughout your retirement.

Estate and Charitable Gift Planning

Planning your estate and charitable gifts is about leaving a legacy that reflects your values. We help you create an estate plan that is designed to ensure your assets are distributed according to your wishes and in the most tax-efficient manner possible. Whether you wish to support charitable causes, provide for your family, or both, we design a plan that honors your legacy.

Facilitating Multi-Generational Wealth Transfer

Preserving wealth across generations requires careful planning. We assist in facilitating multi-generational wealth transfer, helping to ensure that your financial legacy benefits your heirs and continues to grow. This includes structuring trusts, setting up family governance, and educating the next generation on managing wealth responsibly.

- Transparent Pricing with a Focus on Value

Base Annual Retainer Fee

Our base annual retainer fee for financial planning, analysis, and advice is $3,600. This fee reflects the comprehensive nature of our services and our commitment to providing high-value, personalized financial guidance.

Retainer Down Payment

For more complex financial situations, the fee may be higher to account for the additional time and expertise required. To make our services accessible, we require a down payment of half the retainer fee upfront, with the option to pay the remainder on a monthly basis. This flexible payment structure allows you to invest in your financial future without unnecessary strain on your cash flow.

Complimentary Holistic Advice

Clients with a minimum of $750,000 in household investment advisory assets under our management enjoy holistic financial advice at no additional charge.